Reuters, the news and media division of Thomson Reuters, is the world’s largest multimedia news provider, reaching billions of people worldwide every day. Reuters provides business, financial, national and international news to professionals via desktop terminals, the world’s media organizations, industry events and directly to consumers. Corso is searching for dividend-paying companies in cyclical sectors such as financials, where valuations are less expensive. The fund, which tracks companies that have increased dividends annually for the past 25 years, is up around 7.5% this year, compared with a nearly 19% gain for the S&P 500. With two decades of business and finance journalism experience, Ben has covered breaking market news, written on equity markets for Investopedia, and edited personal finance content for Bankrate and LendingTree. Miranda Marquit has been covering personal finance, investing and business topics for almost 15 years.

- Dividends paid by real estate investment trusts (REITs) or master limited partnerships (MLPs) are typically classified as ordinary dividends and taxed as regular income.

- On the payment date, the following journal will be entered to record the payment to shareholders.

- Investors can find all of the dividend increases, decreases, initiations, suspensions, updates and regular dividend announcements for a given day.

- If you aren’t planning on reinvesting the dividend, don’t indicate that you are.

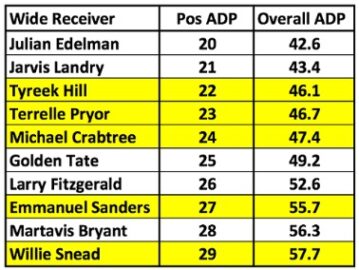

The stocks in the chart may have high yields, but that doesn’t necessarily mean that they’re the best dividend stocks for any investor. The ideal portfolio varies person to person, based on individual goals and timelines for those goals. Besides, many investors are better off buying index funds rather than individual stocks.

Just getting started with stocks?

For investors who rely on their dividends to meet regular expenses, the money invested in dividend stocks leads to a steady dividend payment. And investors who are reinvesting dividends can build wealth slowly due to the benefit of compounding. This kind of compounding is why dividends accounted for 42% of the total return of the S&P 500 from 1930 to 2019, according to an analysis by Hartford Funds. Preferred stock, on the other hand, usually has a greater claim to dividends. While they don’t have voting rights, preferred stockholders are more assured of receiving dividends at a set rate and are prioritized to receive dividend payments before common stockholders. These regular, set payments mean that preferred stocks function similar to bonds.

- The best dividend stocks are ones that have a long history of not only paying a dividend but growing that dividend.

- In this case, the rising dividend yield is a sign of stress, not a sign of a healthy company.

- Investors who don’t want to research and pick individual dividend stocks to invest in might be interested in dividend mutual funds and dividend exchange-traded funds (ETFs).

- Because they’re often considered an alternative to interest-paying securities, dividend stocks are vulnerable to changes in interest rates.

- The information here is for general informational purposes only and should not be considered an individualized recommendation or endorsement of any particular security, chart pattern, or investment strategy.

An investing strategy built on dividend income can be an important part of any saver’s portfolio, especially as a source of cash flow when it’s time to turn lifelong investments into a retirement paycheck. If a dividend payout is lean, an investor can instead sell shares to generate the cash they need. In either case, the combination of the value of an investment in the company and the cash they hold will remain the same. Miller and Modigliani thus conclude that dividends are irrelevant, and investors shouldn’t care about the firm’s dividend policy because they can create their own synthetically. However, dividends remain an attractive investment incentive, with additional earnings made available to shareholders. Regular dividend payments should not be misunderstood as a stellar performance by the fund.

Dividends are how companies distribute their earnings to shareholders. When a company pays a dividend, each share of stock of the company you own entitles you to a set dividend payment. Dividends can be cash, additional shares of stock or even warrants to buy stock. For example, historically the total annual return (which includes dividends) of the S&P 500 has been, on average, about two percentage points higher than the index’s annual change in value.

Cash Dividends

Passive income-seeking investors might want to allocate more to the SPDR ETF. The fund’s expense ratio is good for an actively managed fund; the dividend yield exceeds the Vanguard offering. The Vanguard ETF offers a “no view” exposure to equities, and the SPDR ETF offers broad-based exposure, but with a “high-yield” twist. The FlexShares STOXX Global Broad Infrastructure Index Fund allows investors to take a “view” of the long-term outlook for global infrastructure spending. Qualified dividends are from companies traded on a U.S. stock exchange. Investors in the 10% to 15% tax bracket don’t pay taxes on these dividends.

Instead of receiving dividends as cash, you can also opt for an automatic dividend reinvestment plan, or DRIP, for eligible securities. With a DRIP, dividends are automatically used to purchase additional shares. This allows investors to accumulate more shares over time and does unlimited vacation time really work and for whom can potentially compound returns but also increases portfolio risk. Dividends are a portion of a company’s profits that it distributes to shareholders. Companies offer dividends to reward their investors, and distribute excess cash that’s not reinvested in the business.

Dividends for Mutual Funds and ETFs

Look for companies with a track record of stable and growing dividends. Stock screeners are essential in this effort—once you’ve screened for stocks with a history of dependable dividend payments, review their history to determine if the payments have steadily increased. Reliable hikes to dividend payments indicates a company’s commitment to returning profits to shareholders. Use MarketBeat’s free dividend calculator to learn how much income your dividend stock portfolio will generate over time. Plus leverage other dividend tools from MarketBeat to identify the safest and highest-yield dividend stocks. Investors with a longer time horizon can focus on buying stock in companies that are growing quickly but currently pay lower-than-average dividends.

Is Verizon a Good Dividend Stock to Buy? – The Motley Fool

Is Verizon a Good Dividend Stock to Buy?.

Posted: Wed, 02 Aug 2023 11:30:00 GMT [source]

She has contributed to numerous outlets, including NPR, Marketwatch, U.S. News & World Report and HuffPost. Miranda is completing her MBA and lives in Idaho, where she enjoys spending time with her son playing board games, travel and the outdoors. Dividends are taxed based on whether they’re qualified dividends or ordinary dividends. Lower, consistent dividend yields tend to be better than either of these options. ETFs and funds that prioritize investments based on environmental, social and governance responsibility.

Choose High Dividend Growth

Divide 80 cents by $50 per share to arrive at a dividend yield of 1.6%. To look under the hood of a high-dividend stock, start by comparing the dividend yields among its peers. If a company’s dividend yield is much higher than that of similar companies, it could be a red flag.

Also, the best dividend stocks have a history of increasing their dividend on an annual basis. The best of the best are known as Dividend Aristocrats and Dividend Kings. These companies have increased their dividend for at least 25 and 50 consecutive years respectively. 1The S&P 500® Total Return Index assumes reinvestment of dividends, includes capital gains and does not reflect the effect of taxes and fees.

Risks of Dividend Investing

At the very least, it’s worth additional research into the company and the safety of the dividend. Lower payout ratios should indicate more sustainable dividends—or a low payout ratio could mean that a company needs to increase its dividend. A payout ratio over 100% indicates a company is returning more money to shareholders than it is earning, and it may need to lower its dividend—or that its earnings are under pressure. A steadily rising payout ratio, on the other hand, could indicate that a company is healthy and generating reliable returns in a mature industry. But if you’d reinvested all dividend payments back in the fund over the same period, your annualized return would have been 6.2%, for a cumulative return of 247%. Buying the stocks of companies that pay good dividends is one of the best ways to invest.

Dividend ETFs or index funds offer investors access to a selection of dividend stocks within a single investment — that means with just one transaction, you can own a portfolio of dividend stocks. The fund will then pay out dividends to you on a regular basis, which you can take as income or reinvest. Dividend funds offer the benefit of instant diversification — if one stock held by the fund cuts or suspends its dividend, you can still rely on income from the others. Let’s say you’re looking at a stock that paid $5 in annual dividends and had until recently been valued at $100 a share. But the company’s business came under pressure, and its shares fell to $50—although it’s still paying $5 in annual dividends.

There is a cut-off prior to the record date called the ex-dividend date. Those who buy the stock on or after the ex-dividend date are not eligible to receive the upcoming dividend. The important thing to remember is that you typically need to purchase a stock at least a couple days before the record date to officially own it in time to be eligible to receive the dividend. Another reason for dividend payers’ appeal is a broadening of the market’s rally from the cluster of huge tech and growth stocks that led gains for most of the year into other areas. The S&P 500 energy and financials sectors are up 5.7% and 5.6% this month, respectively, compared with a 2.5% gain for the broader index.

Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master’s in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology.