Our unwavering dedication to empowering our traders and nurturing their growth trajectory has positioned us as a formidable figurehead in the financial sector. Our infrastructure, echoing our dedication, delivers swift trade execution and low latency connectivity, courtesy of the IBM Cloud. People who write reviews have ownership to edit or delete them activtrades forex review at any time, and they’ll be displayed as long as an account is active. Above all, our experts assess whether a broker is trustworthy, taking into account their regulatory credentials, account safeguards, and reputation in the industry. DayTrading.com is committed to helping traders of all levels make informed decisions about which broker to trade with.

- ActivTrades stands as a paragon of excellence in the trading realm, having secured a medley of accolades from various international arenas.

- The platform features an intuitive interface, yet provides cutting-edge functionalities for experienced traders of all trading styles with access to more than 90 technical analysis indicators.

- At the heart of our trading infrastructure is the unparalleled prowess of the IBM Cloud.

- High leverage makes traders more exposed to the markets as it can increase profits and increase losses when the price goes against prediction.

Respectively, Islamic Account or Swap-Free Accounts are also available for those who comply with Sharia laws. Recently, ActivTrades serves also an office in Dubai to cover Middle East trading needs. Generally, the entire procedure, when armed with the necessary documentation, is swift and can often be wrapped up within 24 hours. Notably, ActivTrades refrains from imposing a mandatory initial deposit, making the account initiation phase more accessible to a wider range of aspiring traders. Specifics pertaining to currency conversion fees should be verified directly due to variations depending on account type and trading activity. Information regarding overnight funding fees and guaranteed stop order fees may be subjected to specific account types and should be confirmed directly with ActivTrades.

The broker’s website and trading platforms are available in these languages, providing traders with a user-friendly and localized trading experience. The ActivTrader platform is designed to offer traders an intuitive and easy-to-use trading experience with advanced charting tools and a range of trading features. Part of its offering is a mobile trading app that allows traders to manage their accounts and stay connected to the markets. ActivTrades offers a broad range of accounts and tools where users can trade forex, indices, commodities, cryptos and shares.

Platform & Trading Experience

Cross-asset diversification is possible through 15 commodities, while over 450 equity CFDs are maintained. Complementing them are eight cash index CFDs, 16 forward indices, and seven bond CFDs. Most retail traders will find the overall choice suitable, while advanced and professional traders, as well as fund managers, will swiftly encounter limitations. Novice traders use them to get familiar with using platforms, conduct technical analysis using indicators, and develop basic trading skills. Professional traders demo test new strategies and ideas before risking real money.

The bonus system takes the form of collecting points which bring in cash into your trading account. Also, the points can win you special gifts like tablets, iPads, etc. The ActivTrade bonuses include a 1000 point welcome bonus which the newcomer receives; and a 1500 point referral bonus, which is based on bringing in new traders.

High leverage makes traders more exposed to the markets as it can increase profits and increase losses when the price goes against prediction. Ultimately, it’s better to give traders a choice and let them decide for themselves. Cryptocurrencies have become very popular among financial speculators recently due to their high volatility. ActivTrades offers access to trading the 16 most popular crypto CFDs, including BTC/USD, ETH/USD, LTC/USD, BCH/USD, DOT/USD, EOS/USD, LINK/USD, XLM/USD, NEO/USD, ADA/USD, and DOGE/USD, etc. However, before deciding to participate in Foreign Exchange (FX) trading, you should carefully consider your investment objectives, level of experience and risk appetite. All forms of trading carry a high level of risk so you should only speculate with money you can afford to lose.

Trading Features

Withdrawals can be made through bank transfers, Neteller, Skrill, and PayPal. All withdrawals are free except via bank transfers like Citibank or Moneycorp which incur a £9 fee. ActivTrades PLC is regulated by the UK Financial Conduct Authority and the Securities Commission of the Bahamas. All withdrawals are free unless transferring to Citibank or Moneycorp which incur a £9 charge.

ActivTrades offers trading accounts in several different currencies, including USD, EUR, GBP, CHF, and JPY. These currencies are used for both deposits and withdrawals from the trading account. The choice of currency for the account can be made during the account opening process, and it is recommended to choose a currency that is convenient for the trader and matches their local currency. All clients are treated equally from an identical CFD account without a minimum deposit.

Does ActivTrades have low fees?

The platform is highly reliable, is available in 21 languages, comes with a strategy tester, and comes with 50 pre-installed technical indicators. In addition, there are 9 different time-frames available for multiple time-frame analysis. MT4 is mostly used for trading Forex pairs, a limited number of cryptos, commodities, and indices. Established in 2001, this Forex broker has steadily grown its customer base to reach over 140 countries.

Fees

ActivTraders also offers a selection of leading trading platforms, including MT4, MT5, TradingView and ActivTrader platforms. ActivTrades has been in operation since 2001 and provides superior protection of its client funds up to £/$1,000,000. The pricing structure and asset selection are acceptable, though the Bahamas subsidiary provides a far superior trading environment than the UK one.

What Trading Platforms Does ActivTrades Use?

Introducing the cutting-edge ActivTrader platform – a harmonious blend of user-friendliness for novices and high-caliber functionalities for seasoned traders. Embark on a journey through the vast financial landscapes, unlocking access to an expansive array of 1000+ CFDs spanning 7 pivotal asset classes. Whether it’s FX, shares, indices, commodities, ETFs, or bonds, ActivTrader is your gateway to global market dominion. The broker strives to always offer their clients transparency, reliability, and safety.

ActivTrades runs a reduced schedule on bank holidays in line with global financial markets. More information regarding specific changes is available on the broker’s website. ActivTrades offers competitive forex spreads as low as 0.5 pips on the EUR/USD and USD/JPY and 0.8 pips on the GBP/USD.

Funding fees with this broker are high compared to industry leaders. Most Forex and CFD (Contracts for Difference) brokers do not charge their clients with such fees. ActivTrades is unwavering in its commitment to adhering to the zenith of regulatory norms, setting benchmarks for the industry. This commitment ensures our clients enjoy the security that comes from partnering with a broker regulated across various jurisdictions. The illustrious ActivTrades Group holds regulation by FCA, SCB, CSSF, CMVM, BACEN, and CVM (ActivTrades CCTVM).

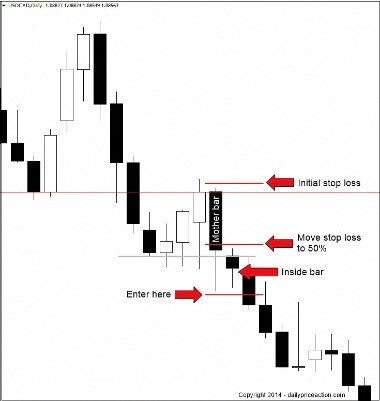

Exotic pairs are characterized by high volatility and increased risks. ActivTrades provides negative balance protection by activating automatic margin Stop Out on your account. Stop Out levels differ from account type to account type and from broker to broker. ActivTrades uses a 50% Stop Out level and as an added bonus, the broker promises to roll your account back to a zero balance if the trading account goes negative.

ActivTrades provides access to various educational materials including seminars, one on one training, webinars, a webinar archive, a trading glossary, educational videos, and educational manuals. Moreover, the broker provides an economic calendar and in-depth market analysis to its clients. Furthermore, the broker doesn’t charge clients inactivity fees or deposit and withdrawal fees. However, be informed that deposits made by debit/credit cards are charged a 1.5% fee and withdrawals through bank transfer are charged 9 GBP per request. Live trading can be a challenge due to the fact that it’s filled with real emotions such as greed, fear, hope, and more. By developing trading strategies that provide a trading edge and implementing risk management strategies, retail and institutional traders profit from the markets.