After locating your working order, you will see that your pairs trade consists of two separate working orders. To edit your working order, place your cursor on either working order, and select Replace Complex Order. To edit and replace a working pairs trade order, first, start by locating the working order. In this example, we’ll view the working pairs trade in the Activity tab. After locating, right-click on either working order and select View Complex Order.

How inflation could help the US dollar – ig.com

How inflation could help the US dollar.

Posted: Tue, 11 Jul 2023 20:34:46 GMT [source]

Pairs Trading can be called a mean reversion strategy where we bet that the prices will revert to their historical trends. A stationary process has very valuable features which are required to model pairs trading strategies. Thus, one should be careful of using only correlation for determining the pairs of the stocks while performing the pairs trading strategy.

What Is Pairs Trading?

However, if you choose to trade 2 stocks, consider doing it over a limited time period (e.g. during the COVID-19 crisis, cruise stocks move together) or use another qualitative layer of analysis. Moreover, profits and losses from these idiosyncratic stock effects might cancel out because you have exposure to many stocks. If you use the end-of-day data, you might not be able to enter at the listed prices. Keep doing this and record the profits and losses of your hypothetical trades.

If they do not form a trend, that means the spread moves around 0 randomly and is stationary. Mean and standard deviation can be rolling statistics for a period of ‘t’ days or minutes or time intervals. Whereas a perfect negative correlation is when one variable moves in the upward direction and the other variable moves in the downward (i.e. opposite) direction with the same magnitude. The value of +1 means there exists a perfect positive correlation between the two variables, -1 means there is a perfect negative correlation and 0 means there is no correlation.

Fundamental and technical analysis in pairs trading

Correlation and cointegration, while theoretically similar, are not the same. Let’s look at examples of series that are correlated, but not cointegrated, https://currency-trading.org/software-development/amazon-aws-interview-experience-for-cloud-support/ and vice versa. First let’s check the correlation of the series we just generated. We’ll plot the ratio between the two now so we can see how this looks.

- Your position may be closed out by the firm without regard to your profit or loss.

- This material does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument.

- After locating, right-click on either working order and select View Complex Order.

- Cryptocurrency pairs are usually traded on exchanges and can be bought or sold just like any other asset on the platform.

- The trade could be immediately closed with a view that the additional return does not warrant the risk or the opportunity cost.

Requiring only a correlation of 0.80 can also decrease the likelihood of the expected outcome. If the securities return to their historical correlation, a profit is made from the convergence of the prices. It is the responsibility of the trader to manage the position according not only to the predetermined buy and sell rules, but also to the changing market environment. The trader must be cognizant of the unexpected news releases affecting either of the instruments in a trade and be prepared to adjust their thinking accordingly. Likewise, they must be mindful of the pair’s price action and constantly adjust the risk/return profile of the trade. In such a situation, the trader could choose 1 of 2 options to prudently manage the trade moving forward.

How to set up a Pairs trade

An intra-sector pairs trade can involve two stocks in a particular sector like technology, health care, or energy, where correlations are often high. Let’s consider two hypothetical large oil companies, MNKY and XYZ. If you believe the pair price will continue to go higher, and MNKY will continue to outperform XYZ, you could buy shares of MNKY and sell shares of XYZ. But if you believe the pair price will go lower, you could sell MNKY and buy XYZ.

A trader is buying the underperformer and selling the outperformer, on the basis that this relationship will change course in due course. However, financial markets are constantly changing, and there are times when the relationship evolves, and the under/over-valuation does not mean revert. In addition, the strategy can be successful in up, down and sideways markets.

Pairs trading strategy

In the hypothetical above, both stocks would have to move significantly against you for this to occur, since in-the-money options were used. Perhaps XYZ does, in fact, fall victim to sector-wide selling, and your call winds up worthless at expiration. On the other hand, ABC once again drops down to $16 by expiration, allowing you to cash in your put option at 7.00, or $700. In this outcome, you still net a profit — albeit a much smaller one of $116, or about 20%. After the Pairs trade mode appears, you may enter the two symbols you wish to pairs trade into the symbols field (yellow arrows) and the quantity you wish to buy and sell (blue arrows).

FX pairs with the same ‘base’, eg EUR/USD and GBP/USD, can be highly correlated in a positive direction. Meanwhile, Brent and WTI can also be positively correlated in the commodities space, while many commodities tend to move inversely to the price of the US dollar. The higher the value, the stronger the positive correlation, with two markets moving in the same direction for a large amount of time. A negative reading indicates https://topforexnews.org/news/weekly-natural-gas-storage-report/ that the two markets are moving negatively, in the opposite direction, while a reading of 0 shows that there is no correlation in the price movement of the two markets. A trade that sees profits of $1000 on one day, but then the second day sees that fall to $500 has a drawdown of $500. But the loss on one position is tempered by profits on the other, and thus the expected drawdown of the strategy can be smaller.

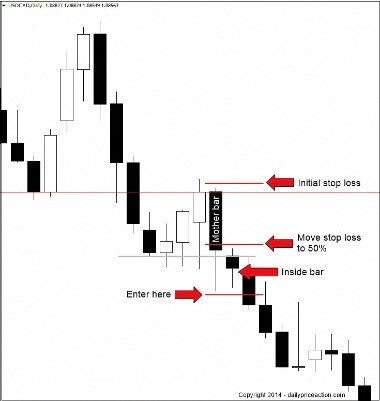

The bottom-up method entails collecting all the data under the sun and checking which 2 (or more) assets behave similarly. Futures are different from stocks in a way that they expire, usually every quarter. We scan the charts of 2 assets to see if they diverge and converge. https://day-trading.info/australia-government-bond-10y/ Visual testing is one of the fastest and most efficient way to get started with pairs trading. The resampling method addresses the weakness of the walk-forward technique, by introducing the assumption that future paths can be simulated by resampling of past observations.